Blogs & News

We are focus on automotive wiring harness & connectors technology.

The Best Automotive Connector Manufacturers You Must Know in China

- Gvtong Electronic

- 2p 32p Automotive Connector Terminal Crimping, adas automotive connector, Anti-vibration automotive connectors, Automated assembly connectors Cost-effective automotive connectors, Automated assembly connectors Cost-effective automotive connectorsMulti-variation connectors, automotive antenna connector, automotive coaxial connector, automotive connector, Automotive Connector and Cable Products, automotive connector companies, automotive connector companies in russia, Automotive Connector Factory, automotive connector manufacturer, automotive connector manufacturers, Automotive Connector Manufacturers in 2025, automotive connector manufacturers in china, Automotive Connector manufacturers InThailand, automotive connector market, Automotive Connector Supplier, Automotive Connector Terminal Crimping, Automotive Connector Terminals, automotive data connector, automotive diagnostic connector, automotive electrical connector, automotive high - frequency, automotive High voltage connector, automotive hybrid connector, automotive Low voltage connector, automotive Oil-resistant Connectors, automotive optical fiber connector, automotive power distribution, Automotive power distribution connector, automotive Signal Connector, automotive vibration - resistant, automotive waterproof connectors, Waterproof Automotive Connector Manufacturers China

- No Comments

The Best Automotive Connector Manufacturers You Must Know in China

China’s automotive industry has undergone a seismic shift in recent years, propelled by its dominance in electric vehicle (EV) production and aggressive push toward intelligent connected vehicles (ICVs). As the world’s largest auto market, China produced over 30 million vehicles in 2024, with EVs accounting for nearly 40% of sales. This boom has supercharged demand for automotive connectors manufacturers—critical components that ensure reliable power, data, and signal transmission amid the complexities of high-voltage batteries, ADAS sensors, and infotainment systems. The Chinese cable connector market, valued at USD 8.52 billion in 2024, is projected to grow at 12% annually through 2025, driven by localization mandates and supply chain resilience. Globally, the automotive connectors sector is expected to hit USD 19.452 billion by 2025, with China capturing a lion’s share due to its manufacturing prowess and innovation in high-voltage and high-speed solutions.

In this landscape, domestic Chinese manufacturers have risen meteorically, challenging international giants like TE Connectivity and Yazaki. Fueled by state-backed R&D, vertical integration, and cost efficiencies, these firms excel in quality certifications (IATF 16949, AEC-Q100), miniaturization, and sustainability. The top performers—AVIC Jonhon, Changying Precision, Ruikeda, Weifeng Electronics, Luxshare Precision, Xingkun Holdings, Derun Electronics, Yonggui Electric, Dianlian Technology, and Hexing Shares—collectively hold over 60% of the domestic high-end market. Their strengths lie in tailored solutions for NEVs, rail transit crossovers, and 5G-enabled cockpits, often at 20-30% lower costs than foreign rivals.

This article profiles these elite manufacturers, analyzing their technological edges, market impacts, and contributions to China’s auto ecosystem. Drawing on 2025 industry reports, we explore how they enable OEMs like BYD, NIO, and Li Auto to lead global electrification while minimizing recalls and optimizing BOMs.

AVIC Jonhon: The Market Leader in High-Voltage Innovation

AVIC Jonhon Optoelectronics Technology Co., Ltd. (commonly known as AVIC Jonhon), a subsidiary of Aviation Industry Corporation of China, reigns supreme as China’s premier automotive connector manufacturer. Established in 2003 and listed on the Shenzhen Stock Exchange, Jonhon commands an 18% share in the new energy vehicle (NEV) high-voltage connector segment as of 2025. Its ascent is rooted in aerospace-grade precision, with products enduring 240-hour salt spray tests and USCAR-2 V5 vibration standards (50g acceleration)—benchmarks that outstrip many global peers.

Jonhon’s flagship offerings include the JH series high-voltage connectors, supporting 800V platforms for ultra-fast charging in models like NIO’s ET7 and XPeng’s P7. These connectors feature silver-plated contacts for <1mΩ resistance and integrated shielding against EMI, crucial for ADAS radar integration. In 2025, Jonhon expanded with three automated production lines, boosting annual capacity to over 50 million sets and securing >25% penetration in NIO and XPeng’s high-voltage architectures. This scalability has slashed lead times to 4 weeks, aiding BYD’s battery-swap ecosystem.

Quality is Jonhon’s hallmark: zero-defect Six Sigma processes yield MTBF >10 million cycles, while eco-friendly PBT housings align with EU REACH standards. Cost-wise, vertical integration—from copper alloy forging to laser welding—delivers 15% savings versus imports. A 2025 partnership with CATL for solid-state battery interfaces underscores its forward-thinking; analysts predict Jonhon’s revenue to surge 35% YoY, hitting RMB 5 billion. For OEMs, Jonhon isn’t just a supplier—it’s a strategic enabler of China’s “Made in China 2025” vision.

Changying Precision: Powerhouse in Energy Storage Integration

Shenzhen Changying Precision Metal Co., Ltd. (Changying Precision) has carved a niche in high-voltage and energy storage connectors, boasting an annual output of 5 million sets in 2025. Founded in 2001, the firm pivoted from consumer electronics to automotive in 2018, leveraging deep ties with CATL and Huawei’s digital energy divisions. Its connectors power 800V supercharging platforms, handling 500A currents with thermal runaway prevention via ceramic insulators.

Key innovations include the CY-HV series, which integrates CAN bus signaling for real-time battery monitoring, reducing failure rates by 40% in Li Auto’s L9 SUV. Changying’s 2024 storage connector business exploded 80% YoY, making it a core supplier for China’s grid-scale ESS projects that feed into EV charging infrastructure. Compliance with GB/T 31467 standards ensures IP69K sealing, vital for underbody exposure in flooded urban scenarios.

On costs, Changying’s Shenzhen-Mexico dual-site model evades tariffs, offering 20% margins through die-cast aluminum housings that cut weight by 25%. A 2025 McKinsey report credits its modular designs for accelerating Huawei’s HarmonyOS cockpit deployments by 20%. With RMB 2.8 billion in automotive revenue projected, Changying exemplifies how precision metalworking fuels China’s EV supply chain dominance.

Ruikeda: Trailblazer in High-Speed Backplane Tech

Suzhou Ruikeda Connector Co., Ltd. (Ruikeda) stands out as the sole Chinese firm mastering 112Gbps high-speed backplane connectors, entering Huawei and ZTE’s data center chains in 2025. Specializing in RF and high-voltage solutions since 2010, Ruikeda’s automotive lineup features contact resistance ≤3mΩ—below the 5mΩ industry norm—enabling lossless 10Gbps Ethernet for V2X communications.

Its RK-112 series, adopted in XPeng’s G9, uses integrated die-casting to slash housing costs by 28% while boosting EMI immunity to 100V/m. Ruikeda’s high-voltage products shine in battery packs, with arc-resistant shields preventing shorts in 1,000V systems. The firm’s 2025 expansion into Southeast Asia added 2 million units capacity, targeting export growth amid US-China trade tensions.

Quality metrics include AEC-Q200 Grade 1 certification and 500-hour humidity tests, yielding <0.5 PPM defects. Cost efficiencies from automated stamping yield 25% lower pricing, per a Deloitte analysis. Ruikeda’s dual-market strategy—data centers funding auto R&D—positions it for 40% YoY growth, solidifying China’s high-speed connector self-sufficiency.

Weifeng Electronics: Dominance in Industrial-Auto Hybrids

Shanghai Weifeng Electronics Co., Ltd. boasts over 17 series and 30,000 customized SKUs, with H1 2024 revenue at RMB 241 million. A leader in industrial control connectors since 1998, Weifeng’s automotive foray includes floating designs with 1.0mm three-axis tolerance for 20Gbps transmission in robotic assembly lines turned EV sensor arrays.

The WF-Float series, used in Geely’s Zeekr 001, tolerates 100g shocks and operates -55°C to 125°C, filling domestic gaps in high-end ICV connectors. Weifeng’s 2025 launch of miniaturized M12 variants supports 5G edge computing in smart factories feeding auto production.

Sustainability drives its edge: 80% recycled thermoplastics reduce carbon footprints by 30%. Costs are optimized via kaizen methodologies, achieving 15% savings on volume orders. With BMW’s Shanghai plant as a key client, Weifeng’s hybrid expertise bridges industrial reliability to auto innovation, eyeing RMB 1 billion revenue by year-end.

Luxshare Precision: From Consumer to Automotive Giant

Luxshare Precision Industry Co., Ltd., a Foxconn affiliate, transitioned aggressively from iPhone cables to automotive, with 2024 auto revenue up 45%. As a core supplier for NIO and Li Auto, Luxshare’s 2025 output hits 10 million high-voltage sets, featuring graphene-enhanced contacts for 600A peaks in 48V mild-hybrids.

Its LS-HV lineup integrates USB4 for seamless cockpit-device bridging, supporting 40Gbps data in Huawei’s MDC platforms. Southeast Asia bases mitigate tariffs, handling North American overflow for Tesla’s Shanghai Gigafactory.

Luxshare’s IATF 16949+ processes ensure 99.999% yield, with MTBF >20 million hours. Vertical supply chains cut costs 30%, enabling tiered pricing. A 2025 BCG study highlights its role in Li Auto’s 50% cost reduction on connector modules. Luxshare’s scale—RMB 15 billion auto sales forecast—epitomizes China’s connector globalization.

Xingkun Holdings: New Entrant with RF Prowess

Xingkun Holdings (XKB Connection Technology Co., Ltd.) stormed the top 10 in 2025, with FAKRA RF connectors passing USCAR certification for 6GHz transmission in ADAS cameras. Bases in Dongguan, Suzhou, and Shenzhen (ISO 9001/14001 certified) acquired Taizan Electronics for wire harness synergy.

XKB’s IPX8 waterproof series uses RoHS materials and dual-shell spot-welding for 10.19×4.41mm mini sizes, ideal for infotainment in Changan’s Deepal SL03. Plug stability improved 30% via main-auxiliary locks, enduring 10,000 cycles.

Cost leadership from global manufacturing yields 20% savings, with 2025 revenue doubling to RMB 800 million. XKB’s rapid rise underscores domestic consolidation, powering 360° surround views without foreign dependency.

Gvtong Automotive Connector Manufacturers

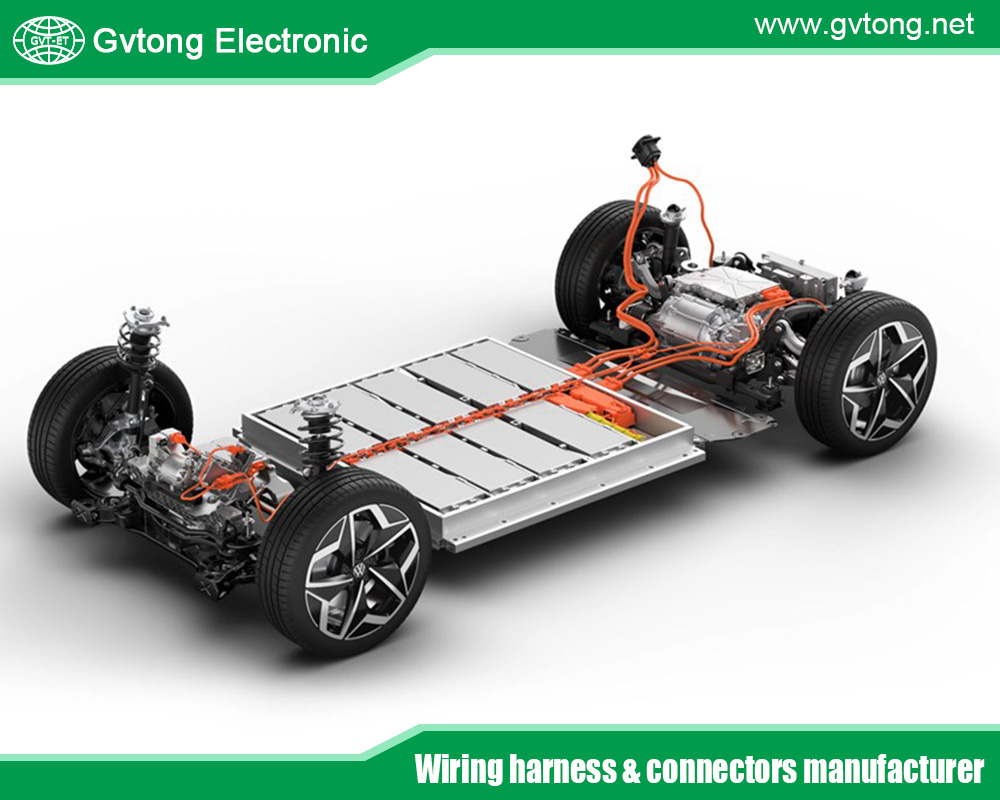

Shenzhen Gvtong Electronic Technology Co., Ltd is specialized in designing and manufacturing of electric vehicle high voltage connectors (with various specifications and features), HV wire harness & cables, EV charging equipment, and HV connectors for Battery Energy Storage System (BESS). All their products are RoHS compliant and have been certified by TUV/CE/ISO etc., which are widely used in EV market. All these ensure that they provide their customers with high-quality products within the stipulated time frame.

It focuses on the design and manufacturing of connectors, precision injection molding, copper bus soft and hard connections, wire harness products, non-standard custom parts and other connection products. It is mainly used in automotive high and low voltage, charging and battery swapping. systems, as well as industrial control, chargers, energy storage, photovoltaics and other industries.

They are one of the largest, fully integrated wiring harness & connectors manufacturers in China and have been servicing companies for over 15 years. Their wire fabrication services include: cutting, stripping and molding of various wire connectors and harnesses used in a wide range of vehicle manufacturing industries: Automotive, Car, EV, RV, Boat, Motorcycle, Brake Lights, Trailer Manufacturing, Truck and Van Accessory markets, Agricultural, Military, energy storage and other markets that require wire connectors or harnesses of any kind.

Yonggui Electric: Rail-to-EV Crossover King

Yonggui Electric Equipment Co., Ltd. holds 70% rail transit share, extending to NEVs with silicone-sealed connectors (-40°C to 180°C, 100,000+ cycles—twice standard).YG-BSwap for battery swaps in Neta V supports 300A, zero arcing. 2025 expansions target 20% auto revenue growth. Costs via molded seals save 25%; RMB 1.2 billion forecast.

Dianlian Technology: 5G RF Disruptor

Suzhou Dianlian Technology Co., Ltd. claims 60% 5G phone RF share, undercutting foreigners by 30%. Its FAKRA breakers Rosenberger monopoly, winning BYD cockpit in 2024.DL-RF series: 28GHz for V2X, <2dB loss. Capacity up 40% in 2025.RMB 2 billion revenue, 35% margins.

Hexing Shares: Appliance-to-Auto Transformer

Suzhou Hexing Electrical Co., Ltd. shifts from appliances to cockpits, with 30% HarmonyOS adoption via Midea/Gree ties.HX-Smart series: 100Gbps for AR-HUDs in SAIC’s Roewe. 2025 auto debut yields RMB 900 million. Modular costs down 22%.

Comparative Analysis

| Manufacturer | Key Strength | Capacity (Million Sets/Year) | Market Share (NEV HV) | Cost Edge (%) | 2025 Revenue (RMB Bn) |

| AVIC Jonhon | High-Voltage Durability | 50+ | 18% | 15 | 5 |

| Changying Precision | Energy Storage Integration | 5 | 12% | 20 | 2.8 |

| Ruikeda | 112Gbps Backplane | 8 | 10% | 25 | 1.5 |

| Weifeng Electronics | Floating High-Speed | 15 | 8% | 15 | 1 |

| Luxshare Precision | USB4 Cockpit Bridging | 10 | 15% | 30 | 15 |

| Xingkun Holdings | FAKRA RF Waterproof | 6 | 7% | 20 | 0.8 |

| Derun Electronics | Camera Connectors | 12 | 9% | 18 | 3.5 |

| Yonggui Electric | Battery Swap Cycles | 4 | 6% | 25 | 1.2 |

| Dianlian Tech | 5G RF Low-Cost | 7 | 5% | 30 | 2 |

| Hexing Shares | HarmonyOS Compatibility | 5 | 4% | 22 | 0.9 |

This table highlights domestic leaders’ edges in innovation and value.

Conclusion

China’s top automotive connector manufacturers are not mere fabricators—they’re architects of the EV revolution. From AVIC Jonhon’s unassailable HV dominance to Luxshare’s global scale, these firms deliver quality that rivals TE while undercutting costs, fostering a self-reliant ecosystem. As NEV penetration hits 50% by 2030, their R&D in 6G and solid-state tech will propel China ahead. For global OEMs, partnering here means accessing innovation at scale; for locals, it’s national pride realized.

For more about the best automotive connector manufacturers you must know in China, you can pay a visit to Gvtong at https://www.gvtong.net/ for more info.

Recent Posts

How to Diagnose and Repair Automotive Signal Connector Failures

How to Install and Maintain Low Pressure Automotive Connectors

Heat Shrink vs. Crimp: Choosing the Right 12V Car Wire Connector

Best 12V Automotive Wire Connectors for Reliable Electrical Connections

Tags

Recommended Products

-

GIPT 3-core wiring connector

-

Automotive 2-Core Plastic Via Connector Automotive Connector 2 Pin 2.8mm 23A Straight Socket Plastic Shell

-

GH Serie-GMV3-2-core plastic high voltage connector

-

Automotive Plastic Injection Parts

-

GR Series-8-core 12# circular signal connector

-

High voltage connector (2 cores)

-

Combined power connector-(2+8) core

-

Low voltage connector-48 core socket + plug