Blogs & News

We are focus on automotive wiring harness & connectors technology.

How to Evaluate the R&D Strength of Automotive Electrical Connector Manufacturers

- Gvtong Electronic

- 2p 32p Automotive Connector Terminal Crimping, Anti-vibration automotive connectors, Automated assembly connectors Cost-effective automotive connectors, automotive antenna connector, automotive coaxial connector, Automotive Connector and Cable Products, automotive connector companies, automotive connector market, Automotive Connector Supplier, Automotive Connector Terminal Crimping, automotive data connector, automotive diagnostic connector, automotive electrical connector, automotive electrical connector manufacturers, automotive electrical connector suppliers in thailand, automotive electrical connector types chart, Automotive electrical connectors, automotive electrical connectors factory, automotive electrical connectors kit, Automotive Electrical Connectors Manufacturer In Thailand, automotive electrical connectors manufacturers, automotive electrical connectors supplier, Automotive Electrical Connectors Thailand, Automotive electrical connectors types, automotive electrical connectors waterproof, automotive high - frequency, automotive High voltage connector, automotive hybrid connector, automotive Low voltage connector, automotive Oil-resistant Connectors, automotive optical fiber connector, automotive power distribution, Automotive power distribution connector, automotive Signal Connector, automotive vibration - resistant, automotive waterproof connectors, best automotive electrical connector suppliers in thailand, High Pressure Connectors, Industrial Control Connectors, Low Pressure Connectors, Top Automotive Electrical Connector Manufacturers, Wind And Solar Storage

- No Comments

How to Evaluate the R&D Strength of Automotive Electrical Connector Manufacturers

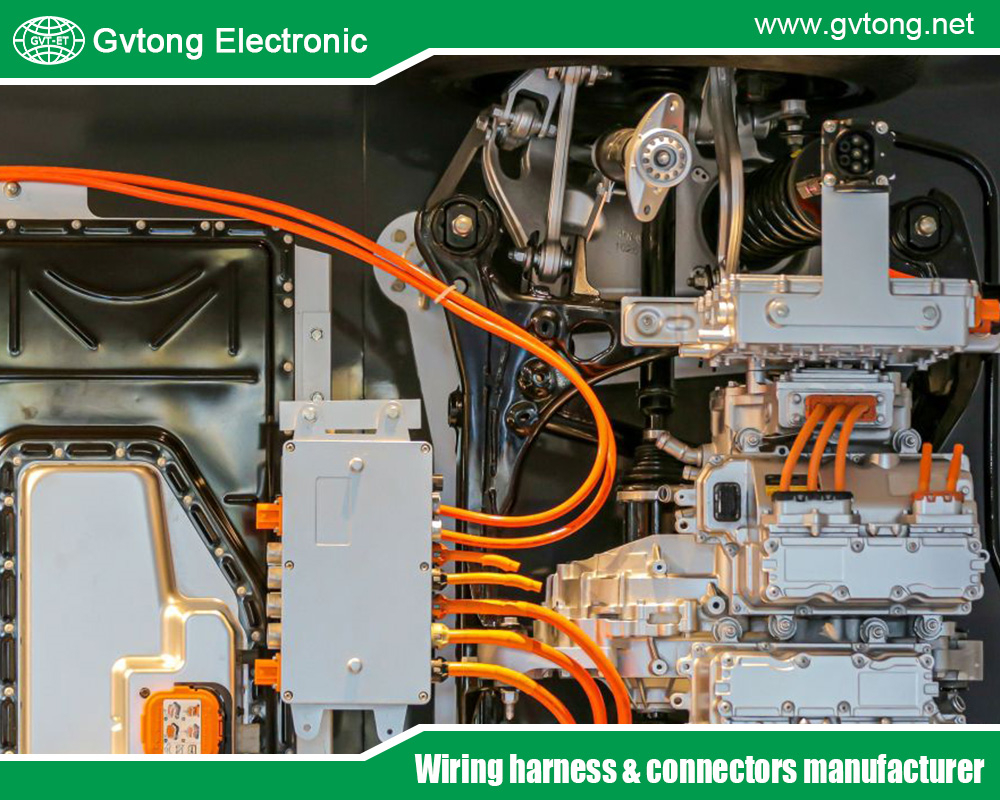

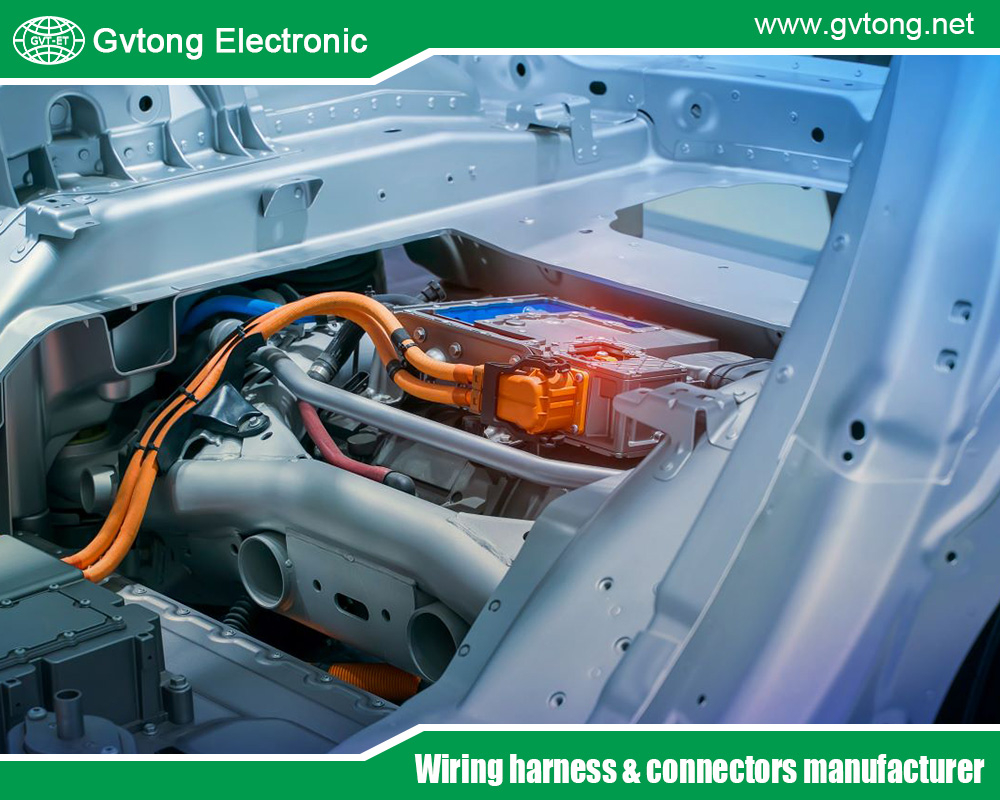

In the rapidly evolving automotive industry, electrical connectors serve as the unsung heroes that enable seamless communication between various electronic systems in vehicles. From powering infotainment systems to facilitating advanced driver-assistance systems (ADAS) and supporting the high-voltage demands of electric vehicles (EVs), these components are critical for vehicle performance, safety, and efficiency. As vehicles become more electrified, connected, and autonomous, the role of automotive electrical connector manufacturers has shifted from mere suppliers to innovators at the forefront of technological advancement.

Evaluating the research and development (R&D) strength of these manufacturers is essential for stakeholders, including original equipment manufacturers (OEMs), investors, and supply chain managers. Strong R&D capabilities indicate a company’s ability to anticipate market needs, comply with stringent regulations, and drive innovation in areas like miniaturization, high-speed data transmission, and sustainability. Weak R&D, on the other hand, can lead to outdated products, compliance failures, and lost market share in a competitive landscape dominated by giants like TE Connectivity, Aptiv, and Yazaki.

This article outlines 10 key technical indicators to assess R&D strength. These metrics draw from industry standards, innovation trends, and performance benchmarks, providing a comprehensive framework for evaluation. By examining factors such as patent portfolios, investment levels, and technological integrations, decision-makers can identify manufacturers poised for long-term success. In an era where the global automotive connector market is projected to exceed $20 billion by 2030, driven by electrification and connectivity, understanding these indicators is not just advantageous—it’s imperative for staying ahead in the automotive ecosystem.

- Patent Portfolio Strength

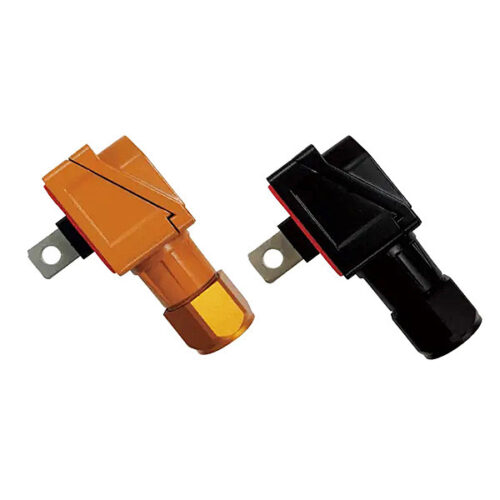

A robust patent portfolio is a cornerstone indicator of R&D prowess in automotive electrical connector manufacturing. Patents reflect a company’s ability to innovate and protect proprietary technologies, such as novel sealing mechanisms for waterproof connectors or advanced materials for high-voltage applications in EVs. To evaluate this, look at the number of active patents filed annually, particularly those related to emerging trends like high-speed data connectors for ADAS or lightweight designs for fuel efficiency.

Quality matters as much as quantity; assess the citation rate of patents, which shows their influence on the industry. For instance, manufacturers like Molex have amassed portfolios emphasizing miniaturization, reducing connector size while maintaining signal integrity. A strong portfolio not only deters competitors but also signals investment in long-term R&D, often correlating with market leadership. Companies with fewer than 50 relevant patents in the last five years may lag in innovation, while those exceeding 200 demonstrate forward-thinking capabilities. This metric can be sourced from databases like the USPTO or EPO, providing quantifiable evidence of a manufacturer’s commitment to pushing technological boundaries in connector durability, thermal management, and electromagnetic compatibility (EMC).

- R&D Investment as a Percentage of Revenue

R&D expenditure relative to total revenue is a fundamental financial metric revealing a manufacturer’s dedication to innovation. In the automotive connector sector, where rapid advancements in EV charging systems and autonomous vehicle integrations demand continuous investment, top performers allocate 5-10% of revenue to R&D. This funding supports the development of next-generation connectors capable of handling voltages up to 1,000V or data rates exceeding 10 Gbps.

Evaluate this by reviewing annual reports or financial disclosures; consistent increases signal strategic focus on areas like corrosion-resistant materials or smart connectors with embedded sensors. For example, firms investing heavily have pioneered innovations in hybrid connectors that combine power and signal transmission, reducing vehicle weight and assembly complexity. Low investment ratios, below 3%, often indicate reliance on outdated technologies, risking obsolescence amid industry shifts toward sustainability. This indicator also correlates with commercialization success, as ample funding accelerates prototyping and testing, ensuring products meet automotive standards like LV 124 for electrical testing. Ultimately, it gauges a company’s resilience in a market projected to grow at 8% CAGR through 2030.

- Innovation Pipeline and Product Launch Rate

The rate at which a manufacturer introduces new products or upgrades is a direct measure of R&D agility. In automotive electrical connectors, this includes launches of connectors for 5G-enabled vehicles or eco-friendly biodegradable alternatives. Track the number of new SKUs (stock-keeping units) released annually—leading companies aim for 10-20 innovations, focusing on miniaturization to fit compact EV architectures or enhanced shielding for EMC in connected cars.

Assess the pipeline through press releases, trade show participations, or partnerships announcements. A healthy pipeline demonstrates effective translation of R&D ideas into market-ready solutions, such as connectors with improved insertion force for automated assembly lines. Metrics like time from concept to prototype (ideally under 12 months) highlight efficiency. Manufacturers with stagnant pipelines may struggle against competitors innovating in high-reliability connectors for harsh environments. This indicator also reflects adaptability to trends like vehicle-to-everything (V2X) communication, where innovative connectors ensure low-latency data transfer. Strong performance here not only boosts revenue but also enhances reputation among OEMs like Tesla or Volkswagen.

- Compliance with Industry Standards and Certifications

Adherence to automotive standards is a non-negotiable indicator of R&D quality. Key certifications include ISO/TS 16949 for quality management, USCAR for connector performance, and SAE J1772 for EV charging. Manufacturers with strong R&D invest in compliance testing, ensuring connectors withstand vibrations, temperatures from -40°C to 125°C, and salt spray corrosion.

Evaluate this by checking certification audits and participation in standard-setting bodies. Advanced R&D teams integrate standards early in design, using finite element analysis (FEA) to predict failures. For instance, compliance with LV 124 ensures electrical integrity under stress, critical for safety in autonomous vehicles. Non-compliance signals weak R&D, potentially leading to recalls. This metric also encompasses environmental standards like RoHS for lead-free materials, reflecting innovation in sustainable connectors. Companies excelling here, like Aptiv, often lead in developing connectors for ADAS, where precision is paramount. Overall, robust compliance indicates a mature R&D process capable of delivering reliable, interoperable products.

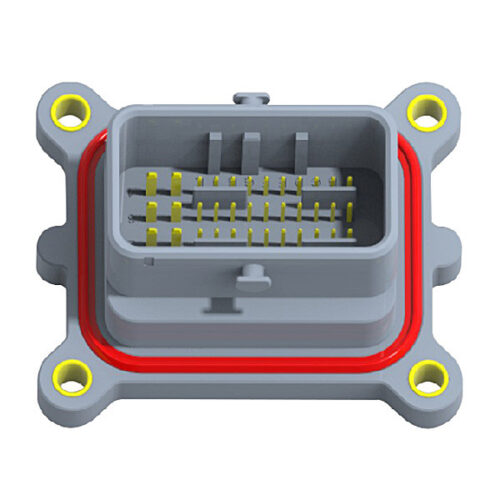

- Advanced Testing and Validation Capabilities

In-house testing facilities are a hallmark of superior R&D in connector manufacturing. Evaluate the presence of labs equipped for environmental simulation, electrical endurance testing, and mechanical stress analysis. Top manufacturers conduct over 1,000 test cycles per prototype, assessing parameters like contact resistance (<10 mΩ) and insertion/withdrawal forces.

This indicator includes adoption of standards like IP67 for ingress protection, ensuring connectors perform in wet conditions. R&D strength is evident in automated testing rigs that accelerate validation, reducing time-to-market. For EV connectors, high-voltage arc testing is crucial to prevent failures. Manufacturers lacking dedicated facilities often outsource, delaying innovation. Metrics such as defect rates post-testing (aiming for <0.1%) quantify effectiveness. Innovations like AI-driven predictive testing further distinguish leaders, allowing simulation of real-world scenarios like thermal cycling in engine compartments. Strong capabilities here correlate with fewer field failures, enhancing trust among OEMs and underscoring a commitment to reliability in an industry where downtime can cost millions.

- Use of Simulation and Modeling Tools

Proficiency in digital tools like CAD, FEA, and computational fluid dynamics (CFD) indicates cutting-edge R&D. These enable virtual prototyping of connectors, optimizing designs for signal integrity in high-frequency applications or heat dissipation in power connectors.

Assess adoption rates—leading firms use software like ANSYS to model EMC, reducing physical prototypes by 50%. This accelerates innovation in miniaturized connectors for space-constrained EVs. Metrics include simulation accuracy, with error margins under 5% validating R&D maturity. Without these tools, manufacturers rely on trial-and-error, inflating costs. Integration with AI for generative design further boosts efficiency, creating connectors with novel geometries for better performance. In the context of autonomous vehicles, simulation ensures low-noise data transmission. This indicator highlights a manufacturer’s technological sophistication, directly impacting product quality and innovation speed in a market demanding rapid iterations.

- Material Science Advancements

Innovation in materials is pivotal for automotive connectors, where demands for lighter, more conductive, and durable options drive R&D. Evaluate use of advanced alloys like copper-beryllium for high conductivity or thermoplastics for insulation in high-voltage EVs.

Key metrics include material tensile strength (>500 MPa) and thermal conductivity (>200 W/mK). Strong R&D teams develop proprietary blends, such as halogen-free compounds for environmental compliance. Track publications or collaborations on nanomaterials enhancing corrosion resistance. Manufacturers advancing in bio-based materials reduce carbon footprints, aligning with sustainability goals. Weak material innovation leads to heavier connectors, compromising vehicle efficiency. This indicator reflects foresight in addressing trends like electrification, where materials must handle 800V systems without degradation. Leaders like TE Connectivity excel here, patenting materials for extreme conditions, ensuring longevity and performance.

- Collaboration and Partnership Networks

R&D strength is amplified through external collaborations with universities, OEMs, and tech firms. Evaluate the number of active partnerships—top manufacturers engage in 5-10 annually, co-developing connectors for ADAS or V2X.

Metrics include joint patents or funded projects, such as those under Horizon Europe for sustainable tech. Partnerships accelerate knowledge transfer, like integrating silicon carbide for efficient power connectors. Isolated R&D signals limitations, while networked firms innovate faster. This indicator also covers supply chain integrations, ensuring material innovations translate to production. In EVs, collaborations with battery makers optimize connector interfaces. Robust networks indicate adaptability and resource leveraging, crucial in a fragmented industry.

- Employee Expertise and Talent Retention

The caliber of R&D personnel is a qualitative yet vital indicator. Assess team composition: PhD holders in electrical engineering, experience in automotive (average 10+ years), and certifications like Six Sigma.

Metrics include turnover rates (<10%) and training hours per employee (>40 annually). Diverse teams foster innovation in connector designs for hybrid vehicles. Talent retention reflects company culture, with incentives like stock options. Weak expertise leads to stalled projects, while strong teams drive breakthroughs in smart connectors with IoT integration. This human element underpins all technical advancements, ensuring sustained R&D output.

- Sustainability and Eco-Innovation Metrics

With automotive shifting green, R&D strength includes eco-friendly innovations. Evaluate recyclability rates (>90%) and carbon footprint reductions in connector production.

Metrics cover life-cycle assessments and adoption of green materials. Innovations like lead-free soldering comply with REACH regulations. Track ESG reports for R&D investments in sustainable tech, such as energy-efficient manufacturing. This indicator signals long-term viability, as regulations tighten. Leaders develop connectors for circular economies, minimizing waste. Strong performance here enhances brand value and meets OEM demands for net-zero supply chains.

Conclusion

Evaluating R&D strength through these 10 indicators provides a holistic view of an automotive electrical connector manufacturer’s capabilities. From patent strength to sustainability focus, these metrics ensure alignment with industry megatrends like electrification and autonomy. By prioritizing manufacturers excelling in these areas, stakeholders can forge partnerships that drive innovation and competitiveness. In a dynamic market, robust R&D isn’t optional—it’s the key to future-proofing the automotive ecosystem.

For more about how to evaluate the R&D strength of automotive electrical connector manufacturers, you can pay a visit to Gvtong at https://www.gvtong.net/ for more info.

Recent Posts

How to Diagnose and Repair Automotive Signal Connector Failures

How to Install and Maintain Low Pressure Automotive Connectors

Heat Shrink vs. Crimp: Choosing the Right 12V Car Wire Connector

Best 12V Automotive Wire Connectors for Reliable Electrical Connections

Tags

Recommended Products

-

Photovoltaic connector plug

-

Signal connector – waterproof, three rows, 35 cores

-

Energy storage wiring harness

-

High voltage connector-2 core

-

Positive and negative terminal box – oblique opening

-

GE Series-48-core Low Voltage Connector-Socket+Plug

-

GH800 Series-1-core plastic high voltage connector

-

GE Series-8-core cylinder connector