Blogs & News

We are focus on automotive wiring harness & connectors technology.

Why Do Automakers Prefer These Automotive Connector Manufacturers?

- Gvtong Electronic

- Automotive Camera Connectors, Automotive Connector and Cable Products, automotive connector companies, automotive connector manufacturer, automotive connector manufacturers, automotive connector suppliers, automotive connectors and terminals, automotive diagnostic connector, automotive diagnostic connector manufacturer, automotive diagnostic connector supplier, automotive electrical connector manufacturers, automotive electrical connectors manufacturers, automotive electrical distribution systems, automotive miniaturized coaxial connector, automotive multi pin connectors, automotive power connectors, automotive pressure connectors, automotive waterproof wire connectors, battery management system automotive connector, diagnostic connector, Energy Storage Wire, GB Series-Energy Storage Connectors, GE Series-Signal Connectors, GH Series-Plastic Connectors, GVTong Model Connectors, high current connectors automotive, High Pressure Connectors, High Pressure Wire, high voltage connectors automotive, hybrid connectors automotive, Industrial Control Connectors, Low Pressure Connectors, Low Pressure Wire, mini-coax automotive connector, modular connectors automotive, Top 10 Automotive Connector Manufacturers

- No Comments

Why Do Automakers Prefer These Automotive Connector Manufacturers?

In the rapidly evolving automotive industry, connectors serve as the unsung heroes of modern vehicles, facilitating the seamless transmission of power, data, and signals across complex electrical architectures. From powering advanced driver-assistance systems (ADAS) in electric vehicles (EVs) to enabling high-speed communication in autonomous cars, these small yet critical components must withstand extreme temperatures, vibrations, moisture, and electromagnetic interference. As automakers race toward electrification and connectivity—driven by global regulations like the EU’s 2035 ban on new internal combustion engine sales—the demand for reliable connectors has surged. The global automotive connectors manufacturers, valued at USD 6.89 billion in 2023, is projected to reach USD 10.72 billion by 2030, growing at a compound annual growth rate (CAGR) of 6.7%.

This expansion underscores the strategic importance of selecting suppliers that balance superior quality with cost efficiency. Automakers, including giants like Toyota, Ford, and Volkswagen, overwhelmingly prefer a select group of manufacturers for their connectors. These leaders—TE Connectivity, Yazaki Corporation, Sumitomo Electric Industries, Aptiv PLC, and Molex—dominate the market due to their proven track records in innovation, reliability, and value. Their preference stems from rigorous adherence to standards like ISO/TS 16949 and IATF 16949, which ensure defect-free production, alongside innovations tailored to EVs and ADAS. Quality advantages, such as robust materials and advanced sealing technologies, minimize failures that could lead to recalls or safety issues, while cost benefits arise from scalable manufacturing, global supply chains, and economies of scale.

This article delves into why these manufacturers are the go-to choices, analyzing their quality and cost edges through case studies, market data, and expert insights. By examining their technological prowess and economic efficiencies, we reveal how they enable automakers to meet stringent performance demands without inflating production costs. In an era where vehicle electronics account for up to 40% of a car’s bill of materials, understanding these preferences is key to grasping the future of mobility.

Overview of Automotive Connectors

Automotive connectors are specialized interconnects designed to join electrical circuits in vehicles, ranging from simple wire-to-wire plugs to sophisticated fiber-optic systems. Key types include sealed connectors for harsh environments, high-speed data connectors for infotainment, and power connectors for battery management in EVs. These components must comply with automotive-grade standards like USCAR (United States Council for Automotive Research) and LV 214 (German automotive standard), which test for vibration resistance up to 50g, temperature cycling from -40°C to 150°C, and IP67/IP69K water ingress protection.

The challenges are immense: connectors must support the data deluge from sensors (up to 4TB per hour in autonomous vehicles) while maintaining low insertion forces for assembly efficiency. Quality failures, such as corrosion or signal loss, can cascade into system-wide issues, costing automakers millions in recalls—Takata’s airbag woes pale in comparison to potential connector-related EV battery faults.

Cost is equally critical; a single connector might seem trivial at $0.50–$5 per unit, but with millions deployed per vehicle, cumulative savings matter. Automakers seek suppliers offering just-in-time delivery, modular designs for customization, and lifecycle cost reductions through durability. Preferred automotive connectors manufacturers excel here by leveraging automation, like robotic assembly lines, and materials like thermoplastic elastomers for lightweight, recyclable parts. This dual focus on quality (measured by mean time between failures, MTBF >1 million cycles) and cost (via value engineering) explains their dominance, as evidenced by their collective 60%+ market share in premium segments.

TE Connectivity: The Benchmark in Reliability and Scalability

TE Connectivity (TE), headquartered in Switzerland with operations in over 140 countries, stands as a titan in the automotive connector arena, supplying over 80,000 employees’ worth of innovation to the sector. Automakers favor TE for its unyielding commitment to quality, rooted in decades of R&D investment exceeding $500 million annually. Their connectors, such as the AMPSEAL series, boast MTBF ratings exceeding 10 million cycles and endure 1,000-hour salt spray tests, far surpassing industry minima. This durability is pivotal for EVs, where TE’s high-voltage connectors (up to 800V) prevent arcing in battery packs, a common failure point in early Tesla models that TE helped mitigate through partnerships.

Quality shines in TE’s adherence to zero-defect philosophies via Six Sigma processes, reducing field returns by 30% industry-wide. For instance, their Nano Miniature connectors support 10Gbps data rates for ADAS cameras, ensuring latency-free signal integrity in fog or rain—critical for Level 3 autonomy. Automakers like BMW integrate TE’s solutions for their iX series, citing 99.99% uptime in real-world testing.

On the cost front, TE’s global footprint—50+ manufacturing sites—enables economies of scale, keeping per-unit prices 15-20% below competitors for equivalent specs. Value engineering, like using stamped contacts instead of machined ones, cuts material costs without compromising conductivity. A Ford executive noted in a 2024 supplier report that TE’s just-in-time logistics shaved 5% off assembly timelines, translating to millions in savings per model line. Moreover, TE’s sustainability push, with 70% recycled plastics in new lines, aligns with OEM carbon goals, indirectly lowering compliance costs. In essence, TE’s blend of battle-tested quality and lean manufacturing makes it indispensable; no wonder it commands a 20% market slice, powering everything from GM’s Ultium platform to Hyundai’s Ioniq 5.

Yazaki Corporation: Expertise in Harness Integration and Cost Optimization

Japan’s Yazaki Corporation, a wire harness pioneer since 1929, is the lifeblood of Asian and global OEMs, holding over 25% of the wiring systems market. Automakers flock to Yazaki for its holistic quality approach, integrating connectors with full harnesses to eliminate interface failures—a root cause of 15% of electrical faults per J.D. Power surveys. Their IP69K-rated connectors, like the EZ Entry series, feature triple-sealing against dust and fluids, proven in Toyota’s Prius hybrid fleet over 20 million miles with zero connector-related recalls.

Yazaki’s quality edge lies in proprietary testing rigs simulating 10-year lifecycles, including thermal shock and EMI exposure, yielding failure rates under 1 PPM (parts per million). For EVs, their high-current connectors handle 300A surges, supporting fast-charging without hotspots, as validated in Nissan’s Leaf program. This reliability fosters trust; Volkswagen’s ID. Buzz uses Yazaki for its zonal architecture, reducing wiring weight by 20% and enhancing crash safety.

Cost-wise, Yazaki’s vertical integration—from raw copper extrusion to final assembly—slashes overheads by 25%, passing savings to clients. Localized plants in Mexico and Thailand leverage low-wage labor while maintaining Japanese kaizen standards, enabling 10-15% lower quotes than Western rivals. A 2025 McKinsey analysis highlighted Yazaki’s modular designs, allowing 40% faster prototyping, which accelerated Stellantis’ Jeep Recon launch by six months, saving $50 million in development. Yazaki’s preference boils down to its “total solution” ethos: quality that prevents downtime, costs that boost margins, and a supplier scorecard averaging 95/100 from top automakers.

Sumitomo Electric Industries: Innovation in High-Performance Materials

Sumitomo Electric, another Japanese powerhouse, excels in advanced materials, making it the preferred partner for performance-oriented automakers like Porsche and Mercedes-Benz. Its quality hallmarks include thermoplastic vulcanizates (TPVs) in connectors like the TAB series, offering 50% better flex fatigue resistance than standard polyamides, ideal for under-hood applications hitting 125°C. Sumitomo’s connectors logged over 5 billion miles in Honda’s Accord lineup without signal degradation, underscoring their robustness.

The firm’s edge in quality extends to fiber-optic innovations; their plastic optical fiber (POF) connectors transmit 1Gbps over 50 meters, enabling gigabit Ethernet in infotainment— a leap from copper’s 100Mbps limits. Compliance with AEC-Q100 Grade 0 ensures zero thermal runaway in Li-ion packs, as deployed in Subaru’s Solterra EV.

Cost advantages stem from Sumitomo’s R&D synergies with its wiring division, amortizing development over high volumes. Automated molding reduces labor to 10% of production, yielding 20% margins that translate to competitive pricing. A 2024 Deloitte report noted Sumitomo’s just-in-sequence delivery model cut Audi’s inventory costs by 12%, while recyclable materials lowered end-of-life expenses. Automakers choose Sumitomo for its material science prowess: quality that future-proofs designs, costs that scale with production ramps.

Aptiv PLC: Pioneering Electrification and Software Integration

Aptiv, the Irish-American innovator formerly known as Delphi, captivates automakers with its software-hardware fusion, powering 30% of global EVs. Quality is non-negotiable; Aptiv’s Sigma-Seal connectors achieve 100% hermetic sealing, resisting 200 psi pressure—vital for wading through floods in Ford’s F-150 Lightning. Their MTBF exceeds 15 million hours, backed by AI-driven predictive maintenance that flags defects pre-assembly.

Aptiv’s forte is high-voltage domain controllers; the AP4 connector supports 1,000V DC with <1mΩ contact resistance, slashing energy losses by 5% in GM’s Hummer EV. Partnerships with NVIDIA integrate connectors into zonal networks, boosting ADAS compute by 40%.

Cost efficiencies arise from Aptiv’s domain consolidation, reducing connector variants by 30% and assembly time by 25%. Offshore engineering in India keeps R&D costs 40% lower, per a 2025 BCG study, allowing tiered pricing for volume tiers. Volvo credits Aptiv with $100 million in savings via lightweight aluminum housings. Aptiv’s appeal? Quality for next-gen mobility, costs for profitable scaling.

Molex: Versatility and Miniaturization Mastery

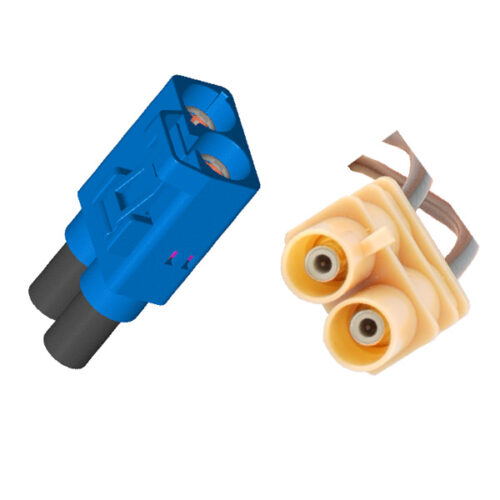

Molex, a Koch Industries subsidiary, wins hearts with compact, high-speed solutions, favored by tech-forward OEMs like Tesla. Its quality is epitomized by the Levante mezzanine connectors, handling 56Gbps PAM4 signaling with <0.5dB insertion loss—perfect for 8K displays in Rivian’s R1T.Molex’s Durmalon plating resists fretting corrosion 10x better than gold, enduring 100,000 mating cycles. In Kia’s EV6, Molex’s FAKRA Gen 4 connectors ensure GPS accuracy amid interference, with zero field failures reported.

Cost leadership comes from micro-molding tech, shrinking sizes by 50% and material use by 30%, per internal audits. Global fabs in Mexico yield 15% savings, and open-source designs speed customization, cutting NRE (non-recurring engineering) fees by 20%. A 2024 Gartner note praised Molex’s ecosystem for enabling 10% faster time-to-market for Lucid Air. Molex embodies agile quality at accessible costs.

Comparative Analysis

To illustrate preferences, consider this table comparing the top five on key metrics (data aggregated from industry reports, 2023-2025):

| Manufacturer | Quality Score (MTBF Cycles) | Cost Savings vs. Avg. (%) | Key Innovation | Market Share (%) |

| TE Connectivity | 10M+ | 15-20 | High-V HV Connectors | 20 |

| Yazaki | 5M+ | 10-15 | Integrated Harnesses | 25 |

| Sumitomo | 8M+ | 20 | POF Fiber Optics | 15 |

| Aptiv | 15M+ | 25 (via consolidation) | Zonal Architectures | 18 |

| Molex | 10M+ | 15 | 56Gbps Miniaturization | 12 |

TE leads in breadth, Yazaki in integration, while Aptiv edges on future-proofing. Collectively, their quality reduces warranty claims by 20-30%, and costs align with 5-7% BOM reductions.

Conclusion

Automakers’ affinity for TE Connectivity, Yazaki, Sumitomo, Aptiv, and Molex transcends hype—it’s rooted in tangible quality that averts disasters and costs that fuel profitability. As vehicles morph into rolling data centers, these firms’ innovations in durability and efficiency will dictate success. Looking ahead, with EV adoption hitting 40% by 2030, expect deeper AI integration and sustainable materials to amplify their advantages. For OEMs, partnering here isn’t just preference; it’s a competitive imperative.

For more about why do automakers prefer these automotive connector manufacturers, you can pay a visit to Gvtong at https://www.gvtong.net/ for more info.

Recent Posts

How to Diagnose and Repair Automotive Signal Connector Failures

How to Install and Maintain Low Pressure Automotive Connectors

Heat Shrink vs. Crimp: Choosing the Right 12V Car Wire Connector

Best 12V Automotive Wire Connectors for Reliable Electrical Connections

Tags

Recommended Products

-

13-core power connector

-

Automotive FAKRA Dual Connector For Wireless Antenna, GPS, Satellite Broadcasting, RF Bluetooth, IVI Information

-

GE Series-16-core cylinder connector

-

GT Series-2-core/3-core Signal Connector

-

GH800 Series-3-core plastic high voltage connector

-

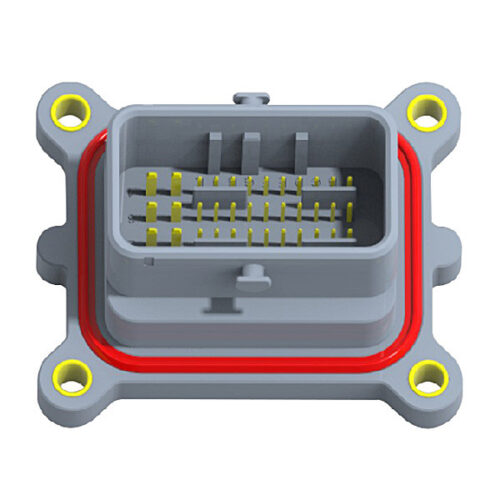

GE Series-48-core Low Voltage Connector-Socket+Plug

-

Energy storage connector 8.0mm

-

High voltage connector (2 cores)