Blogs & News

We are focus on automotive wiring harness & connectors technology.

Challenges Facing China High Current Connectors Manufacturers

- Gvtong Electronic

- Automated assembly connectors, automotive electrical connector, Automotive High Current Connectors Brands, automotive High voltage connector, automotive Low voltage connector, Automotive Low Voltage Signal And Power Connector Solutions, automotive Oil-resistant Connectors, automotive Signal Connector, automotive waterproof connectors, best photovoltaic connectors for solar panels, Best Photovoltaic Solar Battery Connectors For Energy Storage Systems, China Energy Storage Connector Manufacturers, china high current connectors, china high current connectors manufacturers, China High Frequency And High Speed Connectors Manufacturer, China Industrial Electrical Connectors Manufacturers, china photovoltaic connectors manufacturers, electric vehicle EV connector supplier, EV charging connectors, EV charging connectors manufacturers, Fuel cell connectors, Halogen-free automotive connectors, high Current Connectors, high current connectors manufacturers, High Voltage EV Battery Connector For Electric Vehicles, High Voltage High Current Connectors, OEM-specific connectors, Quick-fit automotive connectors, Recyclable material connectors, Redundant safety connectors, Wireless charging connectors

- No Comments

Challenges Facing China High Current Connectors Manufacturers

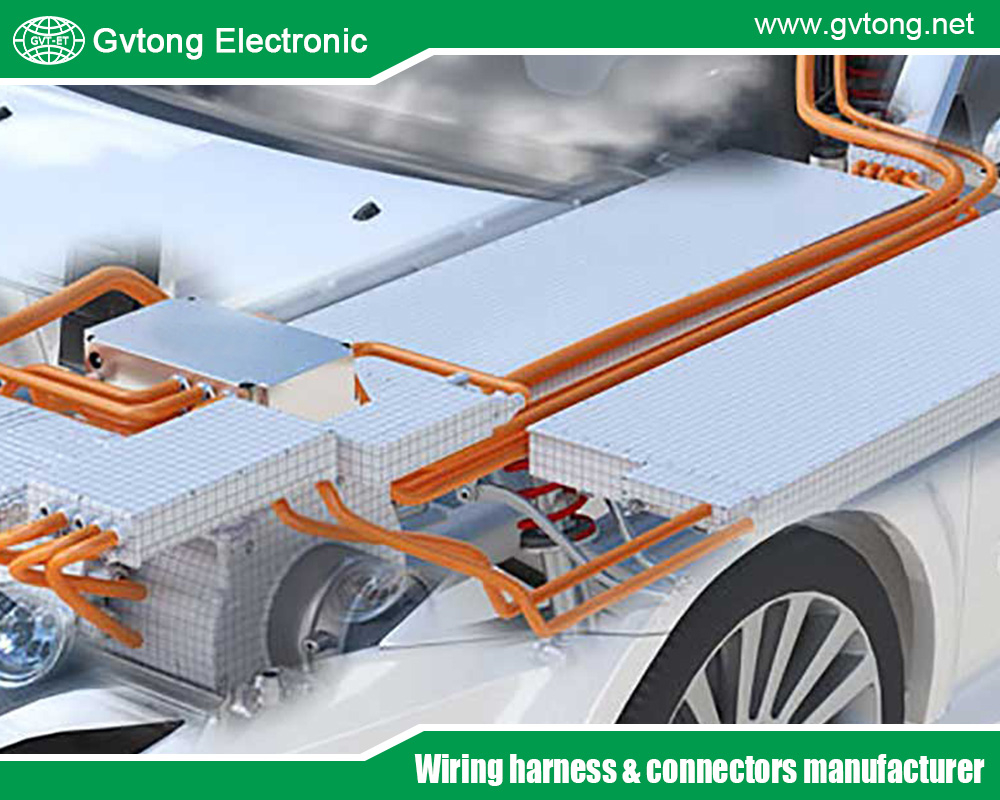

High current connectors are vital components in modern electrical systems, engineered to transmit substantial amounts of electrical power with efficiency and reliability. These connectors play a critical role in industries such as automotive, renewable energy, industrial automation, and telecommunications, where high voltage and current demands are commonplace. As global demand for these components surges, China has emerged as a dominant player in their manufacturing, leveraging its extensive production capabilities and competitive pricing. However, Chinese manufacturers are grappling with significant challenges that threaten their market position and long-term viability. This article examines the primary obstacles facing China’s high current connectors manufacturers, including escalating manufacturing costs, supply chain disruptions, fierce competition, and geopolitical pressures. By analyzing these challenges, we aim to provide a clear understanding of their impact and explore potential pathways forward for the industry.

Overview of High Current Connectors

High current connectors are specialized electrical interfaces designed to handle currents ranging from tens to hundreds of amperes, often at elevated voltages. They are constructed with advanced materials, such as red copper contacts and silver-plated layers, to enhance conductivity, minimize energy loss, and ensure durability under demanding conditions. These connectors come in various forms, including panel-mount connectors, automotive high-current connectors, and energy storage connectors, each tailored to specific applications. For instance, they are integral to electric vehicles (EVs) for power distribution, solar energy systems for efficient energy transfer, and industrial machinery for robust performance.

China has established itself as a global leader in the production of high current connectors, driven by its vast manufacturing infrastructure and cost advantages. In 2023, the Chinese cable connector market was valued at approximately US$7.61 billion, underscoring the scale of its production and export activities. This dominance is fueled by China’s ability to offer competitively priced products while meeting the growing needs of international markets. Yet, as the industry evolves, manufacturers face mounting challenges that could undermine their leadership position if not addressed effectively.

Challenge 1: High Manufacturing Costs

One of the most significant hurdles for Chinese high current connectors manufacturers is the rising cost of production. The manufacturing process requires high-quality raw materials, such as copper and silver, which have experienced price volatility due to global supply constraints and inflationary pressures. Copper, a key component in these connectors, has seen fluctuating costs in recent years, driven by mining disruptions and increased demand from electrification trends. Simultaneously, labor costs in China have risen steadily as the country’s economy develops, diminishing the low-cost advantage that once set Chinese manufacturers apart from their global counterparts.

These escalating costs pose a strategic dilemma. High current connectors must adhere to strict performance and safety standards, necessitating investments in advanced production technologies, precision engineering, and rigorous quality testing. For example, manufacturers must use sophisticated equipment to ensure connectors can withstand high currents without overheating or degrading. However, these investments increase operational expenses, squeezing profit margins. Smaller manufacturers, lacking the scale to absorb these costs, are particularly vulnerable. They face the choice of either raising prices—risking the loss of price-sensitive customers—or cutting corners, which could compromise quality and damage their reputation.

Comparatively, manufacturing costs in other regions, such as Southeast Asia, remain lower, putting additional pressure on Chinese firms to maintain their competitive edge. As costs rise, China’s ability to dominate the market through affordability is increasingly at risk, forcing manufacturers to rethink their strategies to remain viable.

Challenge 2: Supply Chain Disruptions

China’s high current connectors manufacturers rely heavily on global supply chains for raw materials, components, and production equipment. This dependence has become a liability in recent years due to widespread disruptions. The COVID-19 pandemic, for instance, caused factory shutdowns, port congestion, and shipping delays worldwide, leading to shortages of critical inputs and extended lead times. These disruptions exposed vulnerabilities in China’s supply chain, as manufacturers struggled to maintain production schedules and meet customer demand.

Geopolitical tensions have further compounded these challenges. The US-China trade war, which began in 2018, introduced tariffs on billions of dollars’ worth of goods, including electronics components critical to connector manufacturing. These tariffs have raised the cost of importing materials and exporting finished products, eroding profitability. Additionally, export controls and sanctions imposed by the US and other nations have restricted access to advanced technologies and components, forcing Chinese firms to seek alternatives. For example, restrictions on semiconductor-related equipment have ripple effects on the broader electronics supply chain, impacting connector production.

Beyond policy-driven disruptions, manufacturers face risks from fluctuating commodity prices and rising transportation costs. The global shipping crisis of 2021-2022, marked by skyrocketing freight rates and container shortages, highlighted the fragility of China’s export-oriented model. In response, some manufacturers are exploring supply chain localization—sourcing materials domestically to reduce reliance on imports. However, building a fully localized supply chain is a complex, costly endeavor that requires time and significant capital investment, leaving manufacturers exposed in the interim.

Challenge 3: Intense Competition

The high current connectors market is fiercely competitive, with Chinese manufacturers facing pressure from both domestic and international rivals. Within China, a crowded field of producers competes for market share, often engaging in price wars that erode profitability. This internal competition is intensified by the presence of established global players like Molex, Aptiv, and TE Connectivity, which boast strong brand recognition, superior technological capabilities, and a reputation for quality. These international firms cater to premium segments of the market, leaving Chinese manufacturers to compete primarily on cost—a strategy that becomes less viable as production expenses rise.

Technological innovation adds another layer of complexity. As industries such as automotive and renewable energy advance, they demand connectors with enhanced performance, such as higher current capacities, better thermal management, and greater durability. Meeting these requirements requires substantial investment in research and development (R&D), an area where many Chinese manufacturers lag behind their global competitors. Smaller firms, in particular, struggle to fund R&D efforts, risking obsolescence as market needs evolve.

Quality control is also a persistent challenge. While many Chinese manufacturers produce reliable, high-quality connectors, the market includes lower-cost, substandard products that tarnish the industry’s reputation. Customers, especially in Western markets, may hesitate to purchase Chinese-made connectors due to concerns about consistency and reliability. Overcoming this perception requires consistent quality improvements, certifications, and branding efforts—initiatives that demand resources many manufacturers cannot easily spare.

Challenge 4: Geopolitical Factors and Tariffs

Geopolitical dynamics, particularly between China and the United States, have profoundly impacted the high current connectors industry. The US has imposed tariffs on a wide range of Chinese goods as part of its trade policy, with electronics components frequently targeted. In 2025, the proposed 60% tariff increase on Chinese imports by President-elect Trump could further escalate costs for manufacturers exporting to the US, one of their largest markets. These tariffs not only raise the price of finished goods but also create uncertainty, complicating long-term planning and investment decisions.

Export restrictions and sanctions add additional hurdles. For instance, controls on high-tech components and equipment limit Chinese manufacturers’ access to cutting-edge technologies, forcing them to rely on domestic alternatives that may be less advanced or more expensive. This is particularly problematic for high current connectors, which often require precision manufacturing processes enabled by sophisticated machinery.

The broader implications of these geopolitical factors are far-reaching. China’s manufacturing sector has historically thrived on export-led growth, but reduced access to key markets like the US and Europe could lead to overcapacity and downward pressure on prices. This scenario threatens the sustainability of the high current connectors industry, as manufacturers struggle to balance domestic demand with shrinking export opportunities.

Future Outlook and Potential Solutions

Despite these challenges, Chinese high current connectors manufacturers have opportunities to adapt and strengthen their position. One promising strategy is localization—building domestic supply chains to reduce reliance on volatile global markets. By sourcing raw materials and components within China, manufacturers can mitigate the risks of disruptions and tariffs, though this requires investment in local infrastructure and supplier networks.

Innovation is another critical avenue. Investing in R&D to develop advanced connectors—such as those with improved efficiency or sustainability features—can help manufacturers differentiate themselves and command higher prices. For example, breakthroughs in materials science could lead to more cost-effective conductive alloys, lowering production costs while enhancing performance. Embracing green manufacturing practices could also align with global trends toward sustainability, appealing to environmentally conscious customers.

Government support will be instrumental in this transition. China’s “Made in China 2025” initiative aims to elevate the country’s manufacturing capabilities, offering subsidies, tax incentives, and policy backing for high-tech industries like connectors. Such measures can offset rising costs and encourage innovation, helping manufacturers stay competitive.

Industry collaboration offers additional potential. By forming alliances, manufacturers can pool resources, share R&D costs, and address common challenges like quality control. These partnerships could strengthen China’s collective position in the global market, enabling it to compete more effectively with international giants.

Looking forward, the high current connectors market is poised for growth, driven by demand from electric vehicles, renewable energy, and industrial automation. Chinese manufacturers are well-placed to capitalize on this expansion, provided they overcome the challenges outlined here. With strategic adaptations and support, they can maintain their role as a cornerstone of the global electronics industry.

Conclusion

China’s high current connectors manufacturers face a multifaceted set of challenges, including rising production costs, supply chain vulnerabilities, intense competition, and geopolitical pressures. These obstacles threaten their competitiveness in a dynamic and growing market. However, through localization, innovation, government support, and collaboration, manufacturers can navigate these difficulties and seize emerging opportunities. Stakeholders—policymakers, industry leaders, and manufacturers themselves—must act decisively to address these issues, ensuring that China remains a leader in the global high current connectors industry for years to come.

For more about the best challenges facing china high current connectors manufacturers, you can pay a visit to Gvtong at https://www.gvtong.net/ for more info.