Blogs & News

We are focus on automotive wiring harness & connectors technology.

How to Choose the Best Automotive Connector Suppliers in Vietnam

- Gvtong Electronic

- 10-cavity connector supplier, 12 volt 2 pin waterproof connector, 12 volt automotive wire connectors, 12 volt automotive wire connectors supplier, 2 pin waterproof electrical connector, 2 Pin Way Car Waterproof Electrical Connector, 2-cavity connectors manufacturer, 2p 32p Automotive Connector Terminal Crimping, adas automotive connector, ADAS automotive connectors manufacturer, Anti-vibration automotive connectors, Automated assembly connectors Cost-effective automotive connectors, automotive antenna connector, automotive camera connector, Automotive Camera Connectors, automotive connector, Automotive Connector and Cable Products, automotive connector companies, automotive connector companies in russia, Automotive Connector Factory, automotive connector manufacturer, automotive connector manufacturers, Automotive Connector Manufacturers in 2025, automotive connector manufacturers in china, automotive connector market, automotive connector suppliers, automotive electrical connector manufacturers, automotive electrical distribution systems, automotive miniaturized coaxial connector, automotive multi pin connectors, automotive pressure connectors, automotive waterproof wire connectors, battery management system automotive connector, China Automotive Connector Suppliers, high current connectors automotive, high voltage connectors automotive, modular connectors automotive, oem automotive connectors

- No Comments

How to Choose the Best Automotive Connector Suppliers in Vietnam

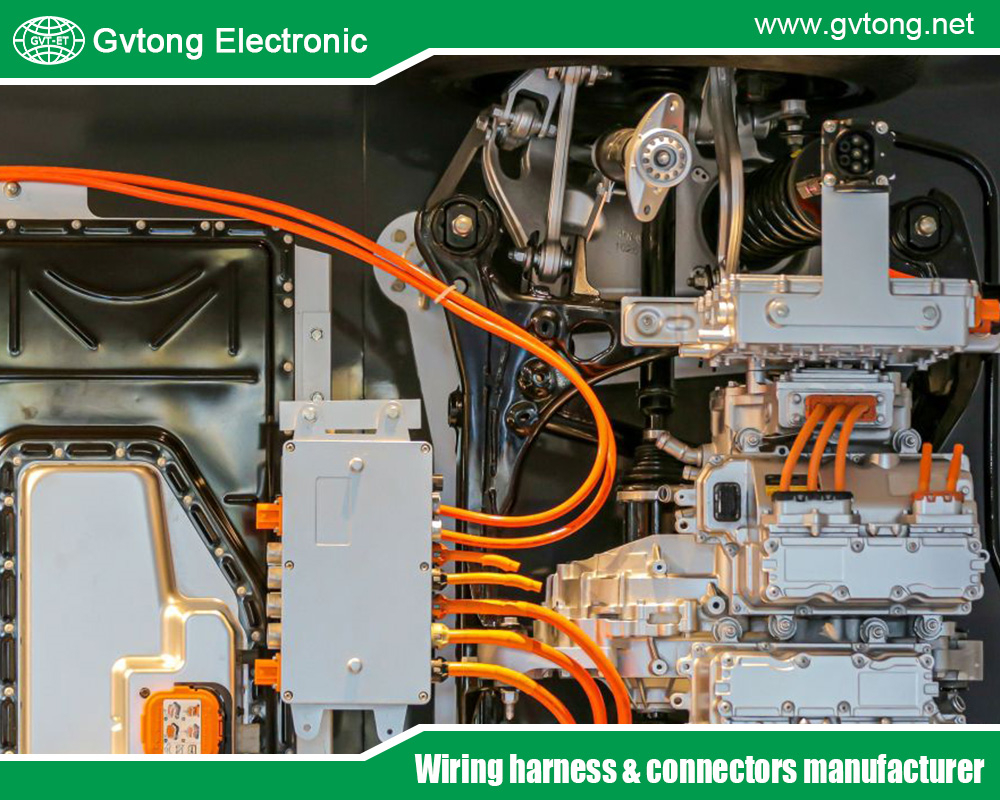

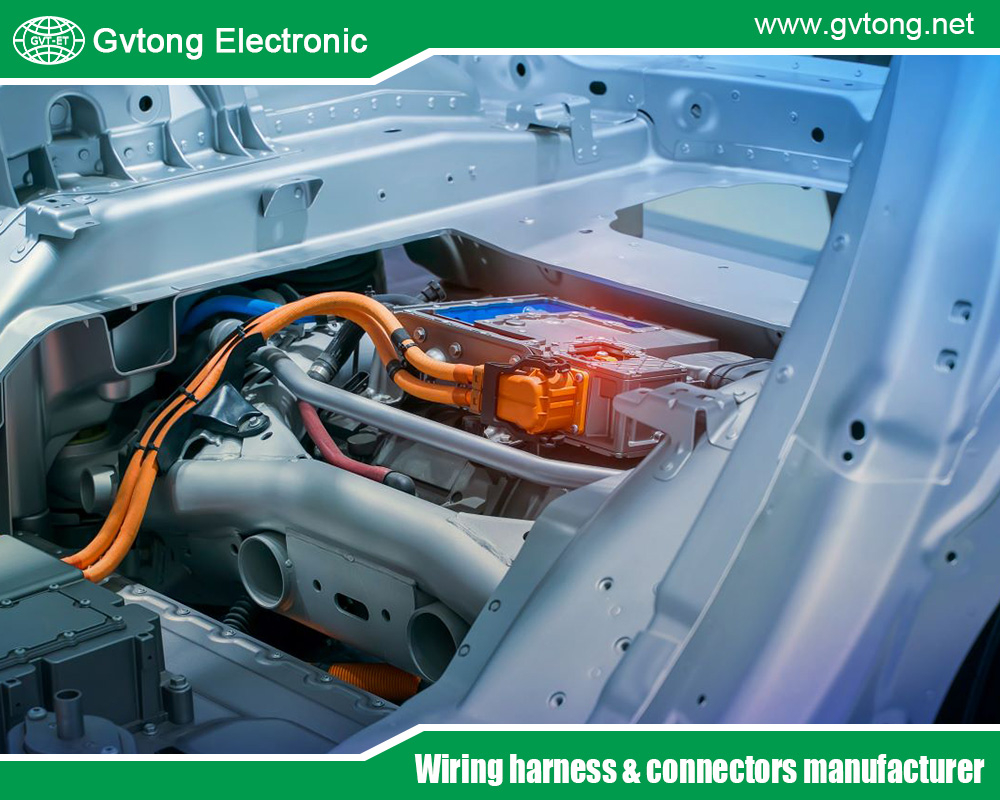

The automotive industry is undergoing a profound transformation, driven by the rise of electric vehicles (EVs), advanced driver-assistance systems (ADAS), and connected technologies. At the core of these innovations are automotive connectors—critical components that ensure reliable electrical and data transmission between sensors, control units, batteries, and infotainment systems. These connectors must endure extreme conditions, including vibrations, high temperatures, moisture, and electromagnetic interference, while supporting high-voltage power and high-speed data rates for features like autonomous driving and vehicle-to-everything (V2X) communication.

Vietnam has positioned itself as a burgeoning hub for automotive manufacturing and supply chain operations in Southeast Asia. With a rapidly growing economy, favorable trade agreements like the EU-Vietnam Free Trade Agreement (EVFTA) and the Comprehensive and Progressive Agreement for Trans-Pacific Partnership (CPTPP), and a young, skilled workforce, Vietnam attracts significant foreign direct investment (FDI) in the automotive sector. The country’s automotive production reached over 500,000 units in 2024, with EVs accounting for a growing share, led by local giant VinFast and international players like Hyundai, Toyota, and Ford. The Vietnam automotive connectors market was valued at USD 618.47 million in 2024 and is projected to reach USD 920.89 million by 2030, growing at a compound annual growth rate (CAGR) of 6.9%. This expansion is fueled by the electrification trend, with EV sales surging from 8,000 units in 2022 to 37,800 in 2023, increasing demand for high-voltage and high-density connectors.

Choosing the best automotive connector suppliers in Vietnam requires a strategic approach, considering factors like quality assurance, technological capabilities, cost efficiency, and alignment with global standards. Vietnam’s suppliers, often subsidiaries of multinational corporations or emerging local firms, offer competitive advantages such as lower labor costs, proximity to Asian markets, and tariff benefits. However, challenges like supply chain disruptions and varying quality levels necessitate thorough evaluation. This article outlines key criteria for selection and recommends top suppliers based on market presence, innovation, and reliability, drawing from industry analyses and company profiles.

Understanding the Vietnam Automotive Connector Market

Vietnam’s automotive sector is shifting from assembly to full-scale manufacturing, supported by FDI exceeding USD 5 billion in 2024. The market for automotive connectors is segmented by type (wire-to-wire, wire-to-board, board-to-board), application (powertrain, safety systems, infotainment), and vehicle type (passenger cars, commercial vehicles, EVs). Key trends include:

- Electrification and EVs: High-voltage connectors for battery management and charging systems are in high demand, with Vietnam aiming for 30% EV penetration by 2030.

- ADAS Integration: Connectors for sensors, cameras, and radars support features like adaptive cruise control, requiring low-latency, high-speed solutions.

- Connectivity and Infotainment: Ethernet and optical fiber connectors enable smart features in connected vehicles.

- Miniaturization: Compact designs for space-constrained applications, with sealing for harsh environments.

Major players dominate through local factories, leveraging Vietnam’s cost advantages to serve ASEAN, Europe, and North America. Suppliers must comply with international standards to integrate into global supply chains for OEMs like VinFast, which exported 10,000 EVs in 2024.

Key Criteria for Choosing Automotive Connector Suppliers in Vietnam

Selecting suppliers involves assessing multiple dimensions to ensure compatibility with your needs. Here are the essential criteria:

- Quality and Certifications

Quality is paramount in automotive applications, where failures can lead to safety risks. Look for suppliers with IATF 16949 certification, the global standard for automotive quality management. Additional certifications like ISO 9001 for quality, ISO 14001 for environmental management, and UL or VDE for safety enhance credibility. In Vietnam, rigorous testing for vibration resistance, IP67/IP68 waterproofing, and thermal cycling is crucial. Evaluate suppliers’ quality control processes, including in-house labs for electrical and durability testing.

- Product Range and Technological Innovation

The best suppliers offer a diverse portfolio, including high-voltage (up to 800V), high-speed (Ethernet-compliant), and miniaturized connectors. For ADAS, prioritize RF and FAKRA connectors for radar and camera integration. EV-focused suppliers should provide solutions for battery packs and fast charging. Assess innovation through patents, R&D investment, and adoption of technologies like automotive Ethernet (IEEE 100BASE-T1) for low-latency data. Vietnam-based firms increasingly incorporate smart materials for better conductivity and weight reduction.

- Supply Chain Reliability and Capacity

Vietnam’s strategic location offers logistical advantages, but evaluate suppliers’ production capacity, lead times, and resilience to disruptions. Factories with vertical integration (e.g., molding, assembly) reduce dependencies and shorten cycles. Check for global footprints to mitigate risks, and prefer those with monthly outputs exceeding millions of units. Proximity to ports like Hai Phong enhances export efficiency.

- Cost-Effectiveness and Value

Vietnam’s labor costs are 30-50% lower than in China, providing competitive pricing. Balance cost with total ownership expenses, including customization and after-sales support. Tariff-free access via FTAs can reduce import duties for EU/US buyers.

- Sustainability and Ethical Practices

With global regulations like the EU’s Green Deal, choose suppliers committed to eco-friendly manufacturing, such as using recyclable materials and reducing carbon footprints. ESG compliance, including labor rights and energy efficiency, is increasingly vital.

- Customer Support and Customization

Opt for suppliers offering technical consultancy, rapid prototyping, and localized service. Strong after-sales, including warranties and training, ensures long-term partnerships.

Recommended Top Automotive Connector Suppliers in Vietnam

Based on market share, innovation, and presence, here are seven leading suppliers. Recommendations draw from their Vietnam operations, product relevance, and alignment with criteria.

- SEWS-Components Vietnam Co., Ltd. (Sumitomo Electric Group)

SEWS-Components Vietnam, part of Sumitomo Wiring Systems, is the largest connector manufacturing facility in Vietnam, established to serve the ASEAN region and beyond. Located in an industrial zone, it produces over 100 million connectors monthly, focusing on automotive and motorcycle components. Products include terminals and connectors for wiring harnesses, suitable for power distribution and signal transmission in vehicles.

SEWS excels in quality, holding IATF 16949 and ISO certifications. Their innovations support EV and ADAS applications, with high-voltage variants for battery systems. Supply chain strength lies in global exports to Japan, North America, and Europe. Cost advantages from scale make them ideal for high-volume OEMs like Toyota and Hyundai. However, customization may require lead time. Recommended for reliability in harsh environments.

- Molex Incorporated (Vietnam Operations)

Molex, a global leader in interconnect solutions, expanded its Hanoi facility in 2022 to 16,000 square meters, committing to Vietnam for over 15 years. The plant focuses on automotive-grade connectors, including MX64 series for high-vibration, extreme-temperature environments. Products cover high-speed data, power, and sealed connectors for ADAS sensors and EV charging.

With IATF 16949 certification, Molex invests in R&D for miniaturization and automation-friendly designs. Their Percept current sensors simplify integration in industrial and automotive applications. Supply chain benefits from proximity to Asian markets, with sustainability focus on energy-efficient production. Molex is cost-effective for innovative projects, though premium pricing applies to advanced tech. Ideal for connected vehicles.

- Yazaki Corporation (Vietnam Presence)

Yazaki, a Japanese giant, supplies connectors through Vietnam distributors and manufacturing ties, serving the local automotive market. Their lineup includes safety connectors for airbags and high-reliability variants for wiring harnesses. In Vietnam, Yazaki supports OEMs with products like the 090II series for sealed applications.

Certified under IATF 16949, Yazaki emphasizes innovation in EV connectors. Their global network ensures reliable supply, with Vietnam operations aiding cost reduction. Strong in customization, they suit ADAS integrations. Potential drawback: Less direct factory info, but market position is solid.

- Amphenol Corporation (Through SWP Vietnam and Local Supply)

Amphenol, a top global connector manufacturer, operates in Vietnam via suppliers like SWP Vietnam Co., Ltd., which represents them for automotive applications. Products include high-voltage power cables, ADAS coaxial solutions, and EV wiring systems. Their AT series offers robust, latching connectors for harsh conditions.

With certifications like IATF 16949, Amphenol focuses on sustainability and high-density designs. SWP provides local support, enhancing logistics. Cost-effective for premium vehicles, they excel in connectivity for infotainment.

- IRISO Electronics Vietnam Co., Ltd.

IRISO’s Vietnam plant, operational since 2008, spans 20,000 square meters and produces FPC/FFC and board-to-board floating connectors for automotive use. Integrated processes ensure high-value production.

Certified for quality, IRISO innovates in floating designs for vibration resistance, ideal for ADAS. Capacity supports mass production, with cost benefits from local manufacturing. Recommended for electronics-heavy vehicles.

- Huizhou Aowa Intelligent Technology Co., Ltd. (Vietnam Factory)

Aowa’s new Vietnam facility, launched in 2024, specializes in automotive wiring harness connectors for intelligent cockpits and NEVs. Vertical integration includes injection molding and SMT, with monthly outputs in millions.

IATF 16949 compliant, Aowa focuses on EV trends, offering customizable solutions. Strategic location aids exports, making it cost-effective for emerging markets.

- Greenconn Corporation (Vietnam Factory)

Greenconn’s Hai Duong plant, completing in 2024, enhances interconnect production for automotive sectors. Advanced equipment ensures quality, with ESG focus.

Products support high-speed applications, ideal for ADAS. Competitive pricing and supply chain optimization make it a rising choice.

Conclusion

Choosing the best automotive connector suppliers in Vietnam involves balancing quality, innovation, and cost amid a growing market projected to exceed USD 900 million by 2030. Suppliers like SEWS, Molex, and others offer robust solutions for EVs and ADAS, leveraging Vietnam’s advantages. Conduct audits, request samples, and build partnerships for success. As Vietnam integrates into global chains, these suppliers will drive safer, smarter mobility.

For more about how to choose the best automotive connector suppliers in vietnam, you can pay a visit to Gvtong at https://www.gvtong.net/ for more info.